Frequently asked questions

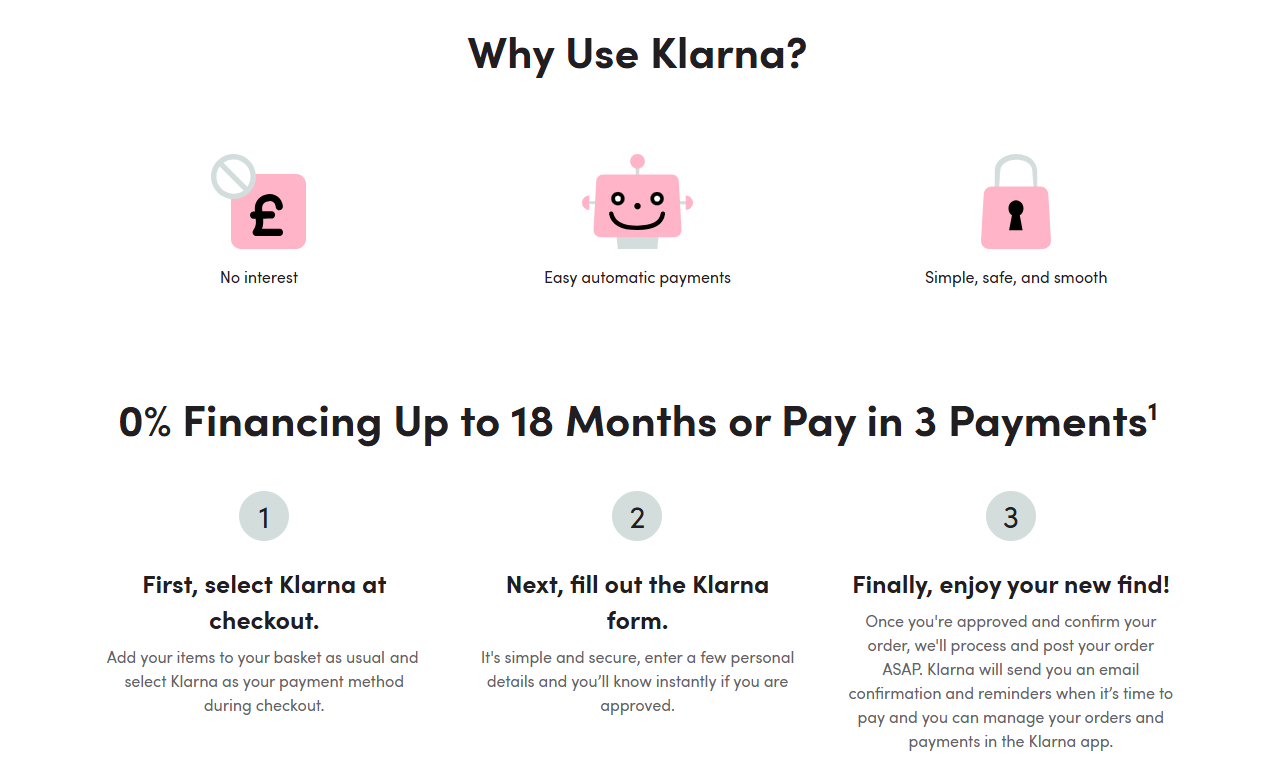

Financing: We have partnered with Klarna to offer credit as an option when purchasing with us. With the Klarna Financing payment plan, you can spread your payments over 6,12, or 18 months at 0% APR. 0% APR Financing is offered for the following basket sizes:

- 6 month 0% Financing on orders £250 or greater

- 12 month 0% Financing on orders £500 or greater

- 18 month 0% Financing on orders £1,200 or greater

Pay in 3: Pay in 3 allows you to spread the cost of your purchase over three equal payments. Your first instalment will be collected from your debit or credit card when DSSE confirms your order and Klarna will automatically collect the second and third instalments 30 and 60 days later, respectively. No interest. No fees if paid on time.

Financing: To be eligible for Klarna Financing you must be at least 18 years old and a UK resident. Your application approval is subject to Klarna's review of the details you provide and your financial circumstances. A full credit search will also be performed when you apply for a Klarna Financing agreement.

Pay in 3: To use Pay in 3, you must be at least 18 years old. Eligibility for Pay in 3 is also subject to your financial circumstances.

Klarna's decision depends upon a number of factors, including address details, cardholder details, the amount of your order, your previous order history, and item availability. For more information about your decision, please get in touch with Klarna directly.

You sure can! Simply log in to you Klarna account, go to the order page, and select 'Pay off early'. You can also use the Klarna app to manage repayments and purchases.

Financing: To pay with 6, 12, or 18 month Financing, you will need to provide your name, billing address, email address and phone number, as well as your employment and bank details.

Pay in 3: To pay in 3 instalments with Klarna, you'll need to provide your mobile number, email address, current billing address, a valid debit/credit card. Klarna will send all correspondence via email, but they'll need your phone number if they need to reach you immediately. Please make sure that you provide accurate information so you receive your payment schedule and any updated order information.

Our Financing options are credit plans with repayment terms ranging between 6-18 months. All Financing plans offered on our website through Klarna are at 0% interest. The monthly instalments will be collected automatically from your bank account via Direct Debit. It is important to ensure you have enough funds in your account to cover the repayment on your due date each month.

Financing: Start the return process as usual, through our website. After we have processed your return, Klarna will adjust your Financing Plan and issue a refund normally within 5 business days.

Pay in 3: Start the return process as usual, through our website. After we have processed your return, Klarna will issue a refund back to the debit or credit card which was originally used on the order normally within 5 business days. If you made a full return, Klarna will refund any collected payments and cancel future schedule payments. If you made a partial return, Klarna will send you an updated statement with an adjusted payment schedule.

Financing: Your monthly payment must reach Klarna by the payment due date. Klarna will report information to credit reference agencies about the payments you make, and about any payments that you fail to make on time. Late or missing repayments may have serious consequences for you. If you are having trouble making repayments, please get in touch with Klarna Customer Service via the support section of the Klarna app or via Klarna’s customer support page.

Pay in 3: Pay in 3 is a credit product and you are required to make your scheduled payments to Klarna. Your payments are automatically withdrawn from your connected card or bank account according to the agreed payment schedule. Klarna will send you multiple friendly reminders before payment is due so you can make sure you’ve got enough money to pay. If payment fails, you may be charged a late fee, subject to Klarna’s T&Cs.

Please visit Klarna’s Customer Service page for a full set of FAQs. Alternatively, you can contact Klarna via live chat from their website, by downloading the Klarna app or over the phone.

See Klarna's Frequently Asked Questions or contact Klarna's customer care team

Local Number: 0203 0050 833

Free phone Number: 0808 1893 333

DSSE UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA FRN 758280) and acts as a credit intermediary and not a lender, offering credit products provided exclusively by Klarna Financial Services UK Limited. Please note that Pay in 3 instalments agreements are not regulated by the FCA. Finance is only available to permanent UK residents aged 18+, subject to status, T&Cs and late fees apply. https://www.klarna.com/uk/terms-and-conditions/